What is a Growth Share Scheme?

Director Nigel Benton discusses growth share schemes and how they can provide private companies in the UK with a flexible way to offer employees a share in the future success of the company.

A growth share scheme, which is also sometimes referred to as hurdle shares, is similar to a performance-based bonus that can be used as a powerful tool to incentivise, reward and retain key team members.

Where some businesses may be disqualified from other share options, a growth share scheme is a tax efficient alternative that allows employers to set their own employee eligibility criteria, implement performance conditions and protect existing shareholder investments.

Below we’ll be looking at the basics of growth shares to help you decide if this scheme would be a good option for your company.

What is a growth share scheme?

Who is eligible for growth shares?

Is a growth share scheme right for my company?

What is a growth share scheme?

A growth share scheme is a form of equity ownership that allows designated employees to share in the growth of a UK company, giving them a stake in the future success of their organisation. Employers can add conditions to growth shares and set eligibility criteria.

How do growth shares work?

The growth share scheme allows employees to share in the profits and growth of their company, these shares accrue value over time, depending on how well the company performs. They are a great option for businesses that may not qualify for other types of share incentives such as an Employee Management Incentive (EMI) scheme.

Growth shares are a special class of shares, distinct from other shares, that are determined by the ‘valuation hurdle’ of the company. These shares are usually designed with specific rights that restrict value until a ‘hurdle rate’ is achieved. This means that once the ‘hurdle’ is met, the rights associated with the growth shares mature and the employee’s entitlement begins.

Your employees will acquire their shares immediately on the date of award and benefit from the rewards of share ownership from day one. It also means that they bare any risks associated with their interest; although, because the initial value of growth shares is normally low the economic risk for employees is limited.

When shares are issued to employees, you must notify HMRC yearly.

You can download our growth shares summary guide for an example of growth shares in action.

Who is eligible for growth shares?

Any company can offer growth shares to any employee (and non-employees) at anytime: however, because of their complexity they often work best as an exit based inventive that would normally be reserved for more senior team members.

If an employee ceases to work for the company, with the exception of 'good leaver' circumstances, growth shares would typically be forfeited assuming provisions have been included in the agreement.

Is tax paid on growth shares?

The short answer is yes; however, growth shares are regarded as a tax efficient way to reward and incentivise employees. Let's take a closer look at the tax implications of a growth share scheme:

Tax liability will depend on two main factors:

- The stage of the shares process you’re in (acquisition or sale)

- The purchase amount of the shares

| At acquisition | At sale |

Where full market value is paid:

Where less than full market value is paid:

|

|

It’s important to remind employees that the tax treatment of growth shares may change after acquisition due to regulatory legislation.

Is a growth share scheme right for my company?

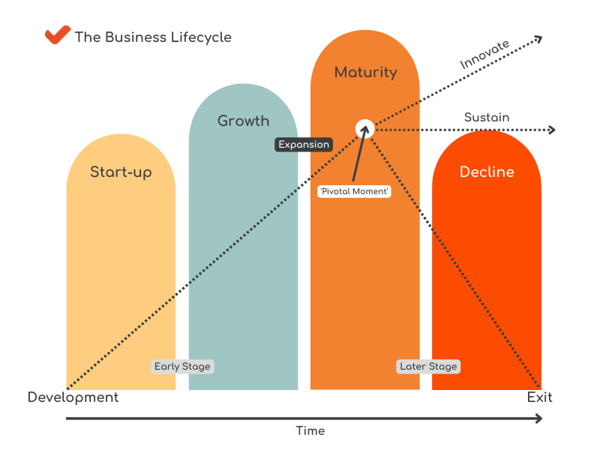

Growth shares can be a beneficial solution for high growth companies with an exit strategy or companies in the growth stage of the business lifecycle looking for ways to keep key employees onboard, or perhaps even bring in new people but need an incentive to compete with the market, and do not qualify for an EMI scheme.

For many growing businesses cash flow may be tight which means growth shares can also be a great option to offer in lieu of salary increases.

The main benefit of growth shares is that they are flexible schemes that can have a wide range of objectives and a company that has a stake in its own stock increases its overall efficiency by minimising turnover and attracting top talent.

Advantages of Growth Share Schemes

- Enhances employee loyalty.

- Encourages employees to work harder.

- Helps to boost company value.

- If you company is eligible for the Enterprise Management Incentive (EMI) plan, growth shares can be used alongside EMIs and other employee share plans.

- It can be issued to anyone, and employers can set their own eligibility criteria.

- Shares are issued immediately, and you can add conditions to share entitlement such as performance targets.

- The investments of existing shareholders are only diluted if and when the share price reaches the hurdle value.

- If the recipient pays full market value on shares there is no income tax liability at the time of acquisition.

- Growth shares can be held for unlimited time.

Disadvantages of Growth Share Schemes

Despite the benefits of growth share schemes, there are also potential downsides. For example:

- There's a risk there won't get any capital gains from the scheme. In this case, shareholders may end up losing out on some potential gains.

- When an employee wants to exit the scheme, they will need to sell their shares. While some growth share schemes provide an option to sell at a later date, they may not give investors as much liquidity as other types of investments.

- At the time of sale, employees will be liable to pay Capital Gains Tax.

Growth Shares Valuation

Valuing a private company is an in-depth process that needs to account for present conditions as well as future growth which requires financial projections. It’s best to bring an accountant onboard to perform the valuation of your business in preparation of growth shares.

How can DSA Prospect Help

Growth share schemes for employees requires planning – our team is available to discuss your options, learn more about incentives, and begin shaping a growth share scheme that works best for your business, including undertaking the valuation of your business.

Disclaimer: The information shared on the DSA Prospect website and social media accounts (inclusive of all content, blogs, communications, graphics, guides and resources) is meant to provide helpful insight and discussion on various business and accounting related topics. It contains only general information that is subject to legal and regulatory change and is not to be used as an alternative to legal or professional advice. DSA Prospect Limited accepts no responsibility for any actions you take, or do not take, based on the information we provide and we always recommend that you speak with qualified professionals where necessary before making any decisions.