Simplifying VAT Compliance for Small Businesses: HMRC Launches Online Estimator

The complexities of Value Added Tax (VAT) can pose a significant challenge for businesses across the UK. From registration thresholds to financial implications, navigating VAT requires time, expertise and resources.

With roughly 300,000 new registrations happening each year, HMRC responded directly to small business feedback by introducing a new VAT Registration Estimator. When using this online tool, small and medium-sized enterprises (SMEs) gain insight into their potential VAT obligations and establish what compliance might mean for their business.

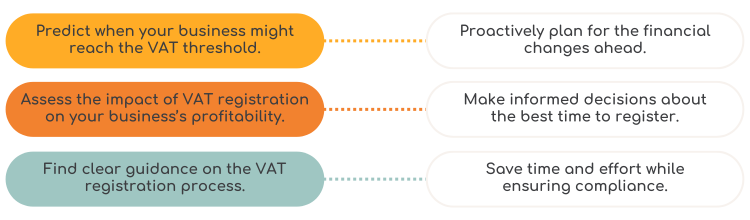

Key Benefits of the VAT Registration Estimator

The VAT Registration Estimator can help businesses understand and meet VAT registration requirements. Whether your business is currently below the VAT threshold or anticipating growth, this estimator provides essential information to guide you through the process.

Determining the Right Time for VAT Registration

Businesses are usually required to register for Value Added Tax (VAT) once their taxable turnover surpasses a certain amount. This is known as the VAT threshold and it is currently set at £90,000 (2024). It's important to note that this threshold is subject to change and if your business operates overseas but provides goods or services to UK customers, you may be required to register for VAT, regardless of your turnover.

Some businesses, even if their turnover falls below the threshold, may opt to voluntarily register for VAT. There are several potential reasons for this:

- Reclaiming VAT on purchases: Voluntary registration enables businesses to recoup significant VAT expenses incurred on purchases, even if they don't currently apply VAT to their sales.

- Simplifying record-keeping: For businesses anticipating reaching the threshold soon, voluntary registration can help them establish VAT systems and procedures in advance, making the transition smoother.

- International trade: Certain business types, like those involved in importing goods or making supplies to other EU countries, might have specific VAT registration requirements

When considering the potential benefits of voluntary VAT registration, it is essential to weigh them against the additional responsibilities that come with VAT compliance.

| VAT-registered businesses collect VAT on sales, which they pass to HMRC. They can also reclaim VAT they've paid on purchases, reducing their overall VAT liability. |

Accessing the VAT Registration Estimator

The VAT Registration Estimator, a free online tool provided by HMRC, can be accessed on the GOV.UK website. The process typically takes around 20 minutes.

To use the tool, you'll need specific information about your business, much of this data can be found in your current or past business records, as well as future business plans. The estimator guides you through a series of questions, offering examples to assist you in completing each section.

Unlike registering for VAT, which requires a Government Gateway user ID, you don't need to create an account to use the estimator and your information is not saved.

How to use the estimator:

- Provide Business Details: Provide basic information about your business including if it's based in the UK, as well as approximate business income and costs.

- Input VAT Information: Indicate which parts of your income and costs are subject to VAT, exempt, or outside the scope of VAT. Choose the correct VAT rate (standard, reduced, or zero) for your goods or services and how you'll handle VAT on sales.

- Review Results: Assess how registering for VAT might affect your business based on the estimator's findings. Consider potential changes to costs, profits, and the overall impact on your customer.

- Explore Further Guidance: Access additional resources and information provided through links within the estimator and on the final result page.

| Businesses need to know before they hit key tax thresholds. Tools and guidance can help them prepare. I’m pleased to see this new VAT registration tool from HMRC that helps a business understand the different types of supplies it makes, and what this means for VAT registration. | |

| - Kevin Sefton, member of the Administrative Burdens Advisory Board |

A Step Forward for SME Support

The launch of the VAT Registration Estimator is a step forward in HMRC providing valuable support to SMEs. By simplifying the process of determining VAT registration requirements, this tool empowers businesses to make informed decisions and promotes a culture of tax compliance within the SME sector.

While the estimator is a helpful tool, it's not a substitute for professional tax advice. In complex situations, seeking guidance from a qualified accountant or advisor is always recommended.

Disclaimer: The information shared on the DSA Prospect website and social media accounts (inclusive of all content, blogs, communications, graphics, guides and resources) is meant to provide helpful insight and discussion on various business and accounting related topics. It contains only general information that is subject to legal and regulatory change and is not to be used as an alternative to legal or professional advice. DSA Prospect Limited accepts no responsibility for any actions you take, or do not take, based on the information we provide and we always recommend that you speak with qualified professionals where necessary before making any decisions.