What you need to know: The end of furlough and other COVID19 support

From 1 October there are some major changes on the way when it comes to Covid19 government support measures.

As the UK continues its path to post-pandemic recovery, businesses and individuals face new challenges due to the withdrawal of some of the key support measures such as furlough, the 5% reduced rate of VAT for hospitality and stamp duty.

For business owners who heavily relied on government support to stay afloat during restrictions and lockdowns, these nearing deadlines may have further implications down the line - planning is therefore vital to ensure your business transitions smoothly away from these measures.

The Furlough Scheme

When does the furlough scheme end?

The Coronavirus Job Retention Scheme (furlough scheme) was scheduled to end October 2020 but was extended with the rapidly changing circumstances surrounding the pandemic.

Government reports indicate that the number of people on furlough has gradually decreased, stating that "Almost three million people have moved off the furlough scheme since March as the economy began to bounce back and businesses reopened."

Now, as the UK focuses on the recovery stage following the easing of restrictions and the government's economical predictions, the furlough scheme will be ending on 30 September 2021.

What is the next step for businesses?

Whilst some business owners may be hoping for another extension, consensus is that further extensions are unlikely - therefore the recommended action is to prepare for the removal of furlough.

Key areas to focus on are:

- Return to work plan - ensure you're in communication with your employees, including those furloughed regarding what a return to the workplace will look like

- Cost-cutting - look at ways to keep costs down such as reviewing overheads and expenses

- Credit control - consider implementing a credit control plan to help improve your cashflow and keep invoices paid

- Supplier communication - keep in touch with your suppliers (particularly if you're having difficulty paying invoices), they may be willing to arrange a payment plan

- Financial position - review your financial position and explore options to resolve any financial issues you may be facing

- Redundancies - if ultimately redundancies need to be made, ensure correct procedures are being followed.

Reduced rate of VAT for hospitality

What is changing with the reduced rate VAT for hospitality?

On 8 July 2020 the government announced a new reduced rate of VAT for hospitality businesses which, similar to the furlough scheme, saw multiple extensions.

However, the temporary 5% reduced rate VAT is now coming to an end on 30 September 2021 and will be replaced by a new reduced rate of 12.5% which will be in effect until 31 March 2022.

The goal is to transition back to the standard rate of VAT early next year, while still supporting the hospitality industry which was heavily impacted during the UK-wide lockdowns.

Do ensure your software and/or sales systems are amended for this change from 1 October - please contact one of the team if you are unsure of how to implement this.

Stamp Duty Land Tax

Is this the end of the stamp duty holiday?

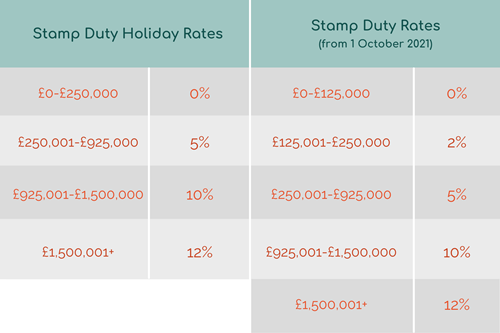

The stamp duty holiday introduced in July 2020 will also be ceasing at the end of September.

How much will I have to pay on property purchases?

Whilst the last year has seen home buyers in England saving up to £15,000, the deadline means that as of 1 October 2021 stamp duty will be back to pre-pandemic levels.

- Home buyers in England will have to pay stamp duty on all purchases from £125,001+

- First-time home buyers in England do not have to pay SDLT on property purchases up to £300,000

How can DSA Prospect help?

Our experienced team have been helping clients plan, manage and mitigate the effects of Covid19 restrictions throughout the pandemic.

To discuss how we can support your business now and in the future, please contact our team today.

Don't forget to subscribe to our newsletter:

Disclaimer: The information shared on the DSA Prospect website and social media accounts (inclusive of all content, blogs, communications, graphics, guides and resources) is meant to provide helpful insight and discussion on various business and accounting related topics. It contains only general information that is subject to legal and regulatory change and is not to be used as an alternative to legal or professional advice. DSA Prospect Limited accepts no responsibility for any actions you take, or do not take, based on the information we provide and we always recommend that you speak with qualified professionals where necessary before making any decisions.