How to boost tax relief as an investor through EIS and SEIS

Are you looking to boost your tax relief while supporting SMEs? The government-approved Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS) are designed to do just that - but how does it work?

According to the 2023 EIS/SEIS statistics released by HMRC, eligible small businesses received investments of around £584 million through EIS and £176 million through SEIS in the fiscal year of 2021-2022.

Investing in eligible small businesses through EIS or SEIS can provide investors with significant tax benefits, as well as the potential to earn higher returns. These schemes offer tax incentives which can effectively reduce an investor's tax liability while also supporting new and innovative businesses.

In this article, we provide a closer look at the benefits of the EIS and SEIS for investors giving you a better understanding of how the schemes work and how they can help your investments grow.

- What is EIS and SEIS?

- What are the tax benefits of investing in EIS and SEIS?

- Who can invest in EIS and SEIS?

- What happens to the tax relief when you sell your investment?

- What risks are associated with EIS and SEIS investments?

What is EIS and SEIS?

The EIS and SEIS schemes are designed to promote investment in small and medium-sized businesses by offering tax incentives to investors. While both schemes provide valuable benefits, there are key differences to consider.

What are the tax benefits of investing in EIS and SEIS?

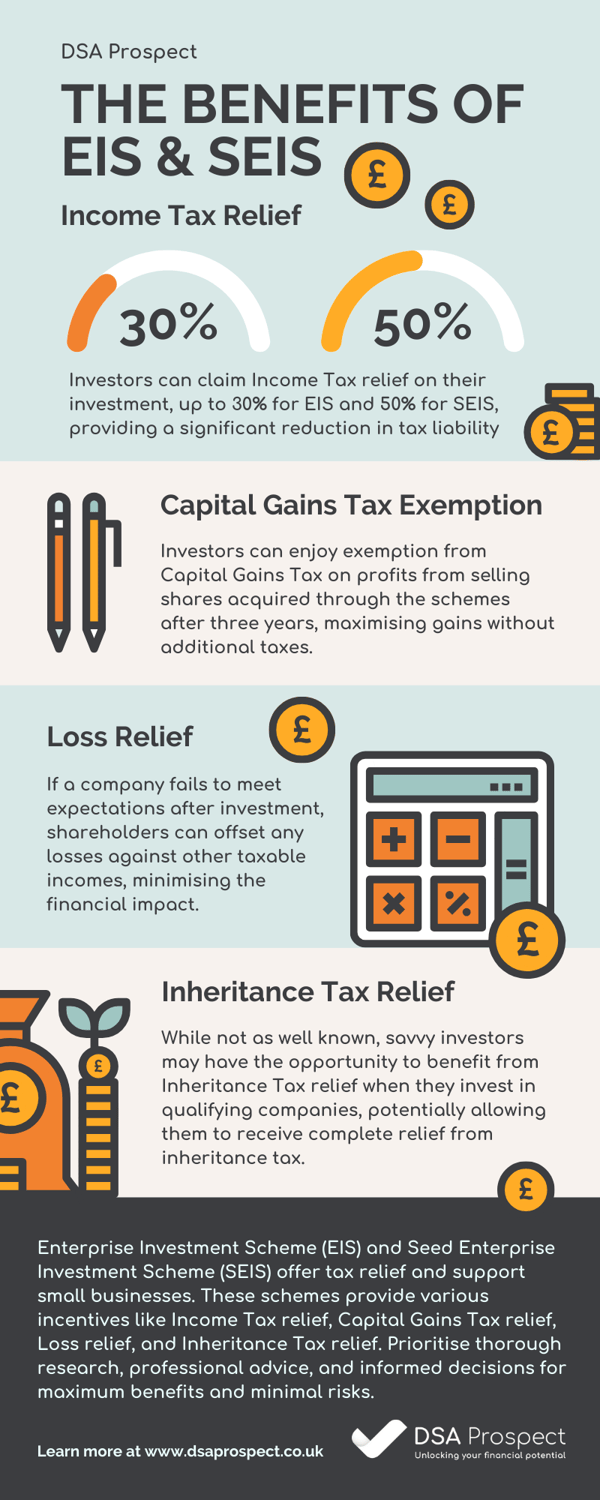

Investing in the EIS and SEIS schemes can provide numerous benefits to investors. Not only do these schemes offer tax reliefs such as Income Tax relief, Capital Gains Tax relief, and Inheritance Tax relief, they also provide the potential for higher returns, making them a win-win for both SMEs and investors.

Let's take a closer look at the key benefits of investing in EIS and SEIS:

Income Tax relief

By investing in companies through EIS and SEIS, you can take advantage of the Income Tax benefits offered by both schemes.

The Enterprise Investment Scheme (EIS) allows for a maximum annual investment of £1 million, with a tax relief of 30% on the amount invested. On the other hand, the Seed Enterprise Investment Scheme (SEIS) has a maximum annual investment limit of £200,000 with a tax relief of 50%.

It's crucial to carefully consider the limits for each scheme and ensure that you stay within them to maximise your tax benefits.

EIS and SEIS Income Tax Relief Rates

| Investment scheme | Annual investment limits for claiming tax relief | Percentage of the investment eligible for claiming |

|---|---|---|

| EIS | £1m* | 30% |

| SEIS | £200,000 | 50% |

* If at least £1 million of the investment is allocated to knowledge-intensive companies, the annual investment limit is extended to £2 million.

When can you claim Income Tax Relief?

For both the EIS and SEIS schemes, investors have the option to claim Income Tax relief either in the tax year they make the investment or in the tax year before if they treat some or all of the investment as being made in the previous year. This flexibility allows investors to optimise their tax planning strategies and take advantage of the benefits offered.

You'll also want to keep in mind that any unused Income Tax relief cannot be carried forward to future tax years.

It's crucial to carefully consider the timing of EIS and SEIS investments to ensure that any relevant relief is claimed within the appropriate tax year to maximise the tax benefits."

- Alec Pridsam, DSA Prospect Director

Capital Gains Tax relief

Capital Gains Tax relief plays a significant role in EIS and SEIS. Under these schemes, investors can benefit from Capital Gains Tax reinvestment relief and exemption from Capital Gains Tax on the disposal of shares.

Capital Gains Tax and investing in EIS/SEIS shares

Investors in the Enterprise Investment Scheme (EIS) have the advantage of deferring payment of Capital Gains Tax by reinvesting their gain from the sale of an asset into qualifying EIS shares. This deferral relief allows investors to delay the payment of Capital Gains Tax until they dispose of the EIS shares or if the shares no longer qualify.

Under the EIS, there is no restriction on the amount of capital gain that can be deferred, as long as the investment is made within one year before or three years after the disposal date.

On the other hand, when investors sell an asset and use all or part of the gain to invest in the Seed Enterprise Investment Scheme (SEIS), they become eligible for Capital Gains Tax exemption on 50% of their initial investment up to a maximum of £100,000.

Capital Gains Tax and selling EIS/SEIS shares

When investors choose to sell their EIS or SEIS shares, they can take advantage of the opportunity to be exempt from Capital Gains Tax on any profits they make. This exemption applies only if the shares have been held for a minimum of three years and if the investor has already received Income Tax Relief.

EIS and SEIS Capital Gains Tax Relief Rates

| Investment scheme | Capital Gains Tax relief on investment | Capital Gains Tax relief type | Capital Gains Tax relief on sale of shares |

| EIS | 100% of investment | Deferral | Yes* |

| SEIS | 50% of investment up to £100,000 | Exemption | Yes* |

Loss relief

If you decide to sell your EIS or SEIS shares at a loss, you have the option to offset the loss amount against your income, after deducting any Income Tax relief that has already been provided. This can be done in either the tax year when you sold the shares or the preceding tax year.

Inheritance Tax relief

One often overlooked benefit of investing in EIS and SEIS is the potential for Inheritance Tax relief. In the event of the investor's passing, this relief can result in a 100% reduction in Inheritance Tax. To qualify for this relief, the investor must have held the investment for a minimum of two years.

Who can invest in EIS and SEIS?

Both the EIS and SEIS schemes are open to a wide range of investors; however, there are certain qualification rules and anti-avoidance provisions that need to be considered.

To invest in EIS and SEIS:

- the investor must subscribe for shares using cash

- the shares must be new ordinary shares with no preferential rights

- the investor (and any associated persons) must not have control of more than 30% of the company's share capital, loan capital, or voting rights.

- the investor should not have been "connected" with the company prior to making the investment (unless they were previously employed by the EIS company)

- the company must be unquoted

What happens to the tax relief when you sell your investment?

In order to fully benefit from the relevant tax reliefs, investors must maintain their investment in a qualifying EIS or SEIS company for at least three years. However, if any of the following events occur during this period, the investor will lose their tax relief:

- Selling some or all of the shares

- The company does not satisfy the requirements of the scheme

- Developing a connection with the company

- Accepting funds, assets, or an abnormally high interest rate on a loan from the company

- The company refunds investments made in shares to investors who have not received tax relief

What risks are associated with EIS and SEIS investments?

Investing in any type of investment carries inherent risks, and it's important to be aware of them. As with all investments, there is a possibility that the value and income from your investment may fluctuate, meaning you could potentially get back less than what you initially invested.

When it comes to investing in small growth companies through schemes like EIS and SEIS, the risk is often significantly higher compared to other investments. The unpredictable nature of small businesses and their increased likelihood of failure contribute to this risk factor. Additionally, investments in smaller companies are often not as easily liquidated as other investments making the selling process much more complex.

Whilst there are advantages to these schemes that can aid in alleviating some of these risks, along with the added protection provided by loss relief, it is important to carefully consider these factors before venturing into the world of EIS and SEIS investments.

How can DSA Prospect help with EIS and SEIS?

Enterprise Investment Scheme and Seed Enterprise Investment Scheme) can be highly beneficial tax relief initiatives that not only provide investors with the opportunity to boost their investment returns but also support small businesses in their growth and development.

These schemes offer various tax incentives, including Income Tax relief, Capital Gains Tax relief, Loss relief, and even Inheritance Tax relief. However, before diving into these investment opportunities, it is crucial to conduct thorough research, seek professional advice, and make well-informed investment decisions to maximise your potential tax relief benefits and minimise the associated risks.

Our team can guide you through the complexities of the schemes, help you understand the risks involved, and assist in making well-informed investment decisions to maximise your tax relief potential through EIS and SEIS investments.

Disclaimer: The information shared on the DSA Prospect website and social media accounts (inclusive of all content, blogs, communications, graphics, guides and resources) is meant to provide helpful insight and discussion on various business and accounting related topics. It contains only general information that is subject to legal and regulatory change and is not to be used as an alternative to legal or professional advice. DSA Prospect Limited accepts no responsibility for any actions you take, or do not take, based on the information we provide and we always recommend that you speak with qualified professionals where necessary before making any decisions.